- DeTraderpreneur

- Posts

- REVEALED🔎: How Sugar Is Killing Your Mental🧠 Trading Game?

REVEALED🔎: How Sugar Is Killing Your Mental🧠 Trading Game?

Sugar isn't inherently bad; it's the excess that does the harm! Let me break it down for you...

Hey Traderpreneur!

HEALTH🧠💪

In regular trading day filled with excitement, yet something felt off – a feeling I couldn't quite shake 🤔 until I uncovered a revelation that reshaped everything.

🍬 A Sweet Discovery

As I navigated through my daily trades, a persistent anxiety lingered, clouding my decision-making.

It was like wading through murky waters, unsure of my next move. Little did I know, the culprit behind this mental fog was hiding in plain sight – sugar.

🌟The Turning Point

One fateful day, amidst the chaos of trading, I stumbled upon a fascinating insight: the profound impact of sugar on mental clarity and focus.

The numbers were staggering – The average adult consumes about 77g of Added sugar daily, almost 20 teaspoons🤯.

This revelation sparked a lightbulb moment, prompting me to reassess my dietary habits and their influence on my trading prowess.

Healthy Sugar vs. Sneaky Added Sugar

There are two sugar players on the stage:

1. Natural sugar: Found in fruits and vegetables like apples, mangos, Carrots.

2. Added sugar: Sneaks into processed foods – think soft drinks, snacks, chocolates, and pizza. Beware! Excessive added sugar can throw off your mental trading groove.

Added sugar has a sneaky way of making food taste irresistibly good, creating what scientists call "hyper-palatability." It hits a "bliss point" where food becomes a reward for our brains, making it hard to hit pause on snacking.

it's time to be mindful of our diets isn’t?

🚫 SUGAR-FREE TRAPS

Hold on, we're not done with the sugar saga yet! Not all foods are created equal, and the way they affect our sugar intake varies.

Don't be fooled by sugar-free or low-sugar fizzy drinks and snacks. Some use tricks to enhance taste without adding sugar, like Maltodextrin, a complex Carbohydrate which turns into pure glucose in the body. Other culprits include fake fibers, artificial sweeteners, and sugar alcohols.

The term "bliss point" is crucial here, as it impacts the three types of food:

1. Unprocessed Food: Think meat, chicken, and eggs.

2. Processed Food: Canned beef, butter.

3. Ultra-processed food: soft drinks, pizza, cakes, snacks. Some ultra-processed foods are okay, like whey protein and dark chocolate.

But too much of those with added sugar can lead to 'glucose dysregulation,' affecting our sugar levels in the body.

🧠SUGAR'S IMPACT ON YOUR TRADING & BUSINESS

1. Anxiety Alert: Excessive added sugar has been linked to an increased risk of anxiety. When your body struggles to regulate sugar levels, stress hormones like cortisol may kick in, making you hesitant to enter or close a trade.

2. Cognitive Crunch: Too much added sugar can fog up your thoughts and memory. Applying a trading strategy might feel like trying to use a EURUSD strategy on Bitcoin without even realizing it! Sometimes you won’t see other confluences.

🌱 THE TRADERPRENEUR APPROACH

Ready for a change? The most helpful move is to cut down on or eliminate ultra-processed foods from your diet. opt for healthier alternatives and watch your mental clarity and trading confidence soar.

So, dear Traderprenuers, take control of your health to elevate your trading and business game. Remember, a healthier you is a wealthier you! 💰. Consistency comes from realization then you eliminate not just looking for what to add.

TRADING📈

HERE IS A QUICK WAY TO UNDERSTAND YOUR TRADING ASSETS BEHAVIORAL

For me, Nasdaq has always been the top pick among indices. Why? Because when you keep your trading simple and understand its behaviors, you and Nasdaq become best buddies for life!

⏰ Timing Is Everything

Let's break down the clock and see how it influences our trading game:

1. Pre-Market Trading Hours: From 4:00 am to 9:30 am New York Time, it's all about gearing up for the market action.

2. Active-Trading Hours: The real deal happens from 9:30 am to 4:00 pm New York Time. Stock market opens, news coming in, more volatility. This is prime time for us traders to shine!

3. After-Hours Trading Hours: Even after the closing bell rings, there's still volatility from 4:00 pm to 8:00 pm New York Time. But remember, it's like the bonus round – proceed with caution! news coming in like the FOMC, Speeches.

We keep it simple and stick to trading during the Active-Trading Hours. Here's our playbook:

Monday to Thursday Routine: We're at the chart 15 minutes after 9:30 am, ready to pounce on opportunities.

If we enter a trade, we hold onto it until 5 minutes before the After-Hours Trading ends 8:00pm.

But we call it a day around 11:30 am if we didn’t enter a trade.

During this window the “Active-Trading Hours”, we're laser-focused on finding that golden opportunity.

The question is; how do you decode the behavior of your trading assets? 🚀

BUSINESS🏢

BEFORE YOU INVEST YOUR PROFITS💵, YOU NEED TO UNDERSTAND THIS!

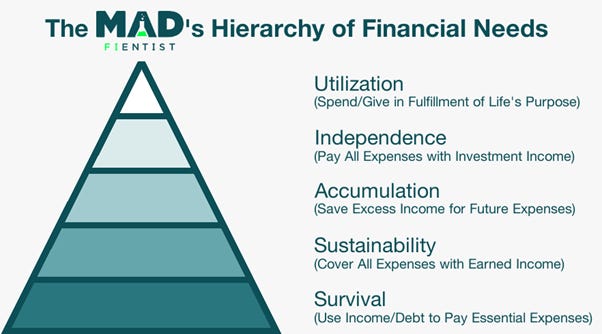

🏢 Let me share a tale that dives deep into the essence of The MAD`s FIENTIST Hierarchy of Financial Needs – a concept that's not just about psychology but resonates deeply with our financial journey.

Remember this: it's 1943, and Abraham Maslow unveils his pyramid of motivation, outlining five fundamental human needs. Basic needs, safety, love and belonging, self-esteem, and self-actualization form the stepping stones to fulfillment.

But did you know? The MAD`s FIENTIST discover this concept but This pyramid isn't just for understanding human desires; it's a roadmap for our financial aspirations too!

Stages;

1.🌱 Starting at the Base: Financial Survival

Imagine you're starting your own adventure in the world of money. Your first goal? Making sure you have enough for the basics – food, a place to live. Debt is the enemy here, and every move should help you avoid it.

Action Step: Look closely at your spending. Cut out what you don't really need and focus on what's important. Pay attention to your budget to keep stress away.

2.🔄 Moving Up: Achieving Sustainability

Now, you're keeping things going, making enough to live comfortably. But watch out for surprises! You need a plan to handle unexpected expenses.

Action Step: Start saving money regularly. Build up a safety net so that sudden expenses don't throw you off track.

💰 Climbing Higher: The Stage of Accumulation

Good job! You're earning more than you're spending now. It's time to start making your money work for you.

Action Step: Learn about different ways to invest your money. The goal is to make it grow over time.

3.🚀 Reaching Independence: Financial Freedom Beckons

Your investments are growing, and they're enough to cover your expenses. You have more freedom to choose what you want to do.

Action Step: Look for ways to make money without having to work all the time. Explore opportunities that let you earn while you sleep!

4.🌐 The Pinnacle: Utilization

Money isn't just about numbers anymore. It's a tool for creating the life you want. Every dollar you spend should bring you closer to your goals.

Action Step: Think about what really matters to you. Make sure your money is going towards the things that make you happy and fulfilled.

Thank you for reading DeTraderprenuer. if you find this post informative feel free to share it.